Borrowing money no longer needs to feel confusing or stressful thanks to smarter matching platforms. Many Canadians now turn to Lend For All Canada as the best place to get a loan with easy applications, fast approvals, and trusted lenders.

Best Place to Get a Loan with Lend For All Canada: Smarter Borrowing Starts Here

Canadians Find Wiser Ways to Borrow Thanks to Loan-Matching Technology

Finding quick, affordable borrowing options has become easier for Canadians who need fast access to funds. Many are turning to smarter platforms that simplify the loan process, with Lend For All Canada leading the way. For those searching for the best place to get a loan, this loan-matching service offers a smoother, less stressful experience by connecting borrowers to trusted lenders without complicated paperwork or endless waiting.

How Loan Matching Makes a Difference

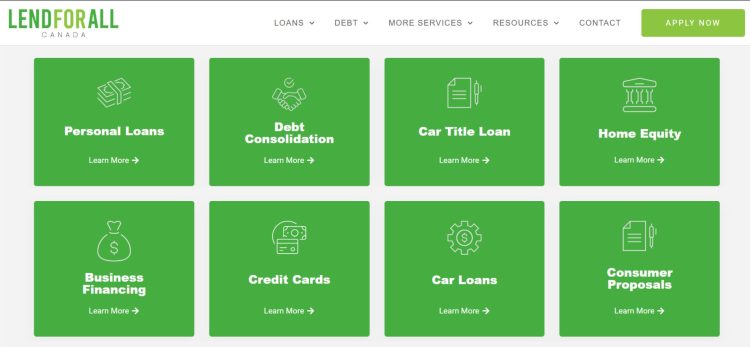

A lot goes into borrowing money. Beyond filling out forms, borrowers must think about loan amount, income and credit score, repayment terms, and even whether a personal loan should carry a fixed rate or a variable rate. Lend For All Canada shortens the gap between consumers and lenders, offering fast access to unsecured personal loans, personal lines of credit, car title loans, and other financial options.

Unlike traditional bank loans, where multiple credit checks might happen and slow down credit approval, Lend For All Canada uses automated loan qualification to connect people with lenders suited to their needs. Borrowers avoid high origination fees and heavy paperwork, saving both time and effort.

Child Tax Loans That Help Stretch the Budget

Child tax loans give families faster access to cash when support payments aren’t enough. Lend For All Canada assists parents in covering short-term needs like groceries, rent, or school expenses without endless paperwork. This loan uses future child benefit payments to unlock extra funds when timing matters. Approval is simple, and the money comes without pressure to commit to long terms. It’s not a bonus—it’s a tool to keep things steady at home. Parents use it to bridge gaps without falling into deep debt. When a budget hits a wall, this loan keeps the basics covered. Families deserve options that work without games.

Loans Without Employment Verification for Real-World Situations

Income comes in many forms, and not every job fits the same box. Lend For All Canada connects people to loans without employment verification, that look at the bigger picture. Self-employed workers, freelancers, and gig workers can apply without chasing pay stubs they don’t have. The process checks identity and ability to repay without dragging through outdated paperwork. These loans work when income is real but doesn’t show up on a slip. Borrowers move forward faster without faking documents or feeling stuck. It’s built for people with income, not just standard jobs. Smart lending fits how people actually earn.

Car Title Loans That Work When Credit Won’t

Car title loans use vehicle ownership to obtain cash when it’s needed. Lend For All Canada connects borrowers to lenders that accept your car’s title as security—without taking your keys. You keep driving while your vehicle’s value works in your favor. There’s no delay from credit checks or slow reviews. Funds land fast, and the repayment terms stay short. Emergencies don’t wait. The loan gives you the tools to respond without giving up control. It’s a direct exchange—real value for real money.

Bad Credit Loans That Open Doors, Not Traps

Bad credit doesn’t mean the end of the road. Lend For All Canada finds bad credit loans that skip the shame and go straight to the solution. The system matches borrowers with lenders who work with low scores and past issues. Applications stay private, simple, and fast without wrecking scores further. Loans cover real needs—not wants—with clear repayment plans that don’t spiral. People take a step forward with cash that fits, not buries.

Payday Loans in Edmonton That Don’t Waste Time

Payday loans in Edmonton cover short gaps fast when bills hit before your paycheque does. Lend For All Canada links borrowers to lenders ready to move now, not later. No office visits, no stacks of paperwork. Just a short form, fast matches, and clear terms. The loans stay small and focused—designed to solve, not drag you down. Rent, utilities, car repairs—whatever can’t wait, gets paid. The timeline fits how real life works. It’s simple and direct, from start to deposit.

Toronto Payday Loans That Actually Move Fast

City life is expensive, and Toronto bills don’t play nice. Lend For All Canada makes payday loans in Toronto easy to access without storefronts, long waits, or dead ends. The system connects you with lenders ready to fund small, short-term loans without judgment. Borrowers cover gaps without blowing budgets or begging banks. Applications stay online, fast, and focused. Toronto residents use payday loans to get through the rough weeks between paychecks. It’s a small boost with no long hooks. The goal is short help, not long trouble.

Payday Loans in Montreal Without Red Tape

Montreal residents facing short-term gaps use Lend For All Canada to find fast, online access to cash. Payday loans in Montreal come without red tape, in-person visits, or high-pressure contracts. The system filters lenders so users get offers that match real needs. Applicants don’t chase paperwork or sit in lines—they apply from home and get matched in minutes. Payday loans work best when they stay small, simple, and clear. Montreal borrowers use them to cover the basics and move on. Cash shows up fast, and the terms are made to end quickly. This is aid without the hassle.

Fixed Rate vs Variable Rate: What to Consider

Choosing between a fixed rate loan or a variable rate loan impacts personal loan payments. A fixed interest rate keeps monthly payments steady throughout the loan term, while a variable interest rate may fluctuate with the prime rate.

Borrowers seeking predictable budgets might prefer the stability of fixed rates, especially when planning major purchases like home renovations. Those willing to risk some change for potentially lower interest costs might explore loans tied to a variable rate.

A personal loan calculator often helps Canadians estimate how different interest rates and term lengths will affect payments. Knowing how much the monthly payments could be ahead of time will help borrowers better manage cash flow.

Understanding Loan Types and Collateral Requirements

Not every loan requires putting assets on the line. Unsecured loans, like many personal loans offered through Lend For All Canada’s lending partners, depend largely on a borrower’s credit score and current income rather than collateral.

Secured loans, on the other hand, demand an asset, such as a car or home, to back the borrowed amount. A car title loan or home equity loan would fall into this category. Both secured and unsecured loans have their own advantages, depending on whether a borrower prioritizes speed, loan amount, or lower interest rate.

Consolidating Debt: A Growing Need

Many Canadians carry higher interest debt from multiple credit cards or payday loans. Consolidating that debt into a single fixed rate loan simplifies payments and often brings down the annual percentage rate overall.

Debt consolidation loans offered through Lend For All Canada’s network provide a way to manage personal finances more easily. Instead of juggling several minimum payments across different cards, borrowers make one clear monthly payment with one interest rate, freeing up cash flow for other needs.

Comparing Loan Offers Before Signing

Comparing loan offers is one of the smartest moves before accepting any funds. Factors such as interest rate, term length, payment frequency (bi-weekly, monthly), credit limit, and fees all play a role in finding the best personal loans for each unique situation.

Lend For All Canada’s system makes it easy to compare offers side-by-side without facing several hard credit checks. This protects the credit score while allowing borrowers to view multiple offers tailored to their profile.

Borrowers weighing the pros and cons of different lenders—whether it’s a major bank like TD Bank, a credit union, or alternative lenders—benefit from seeing clear options in one place. Avoiding unnecessary fees, getting a lower interest rate, and selecting manageable monthly payments help create a stronger borrowing solution.

The Takeaway

Finding the right way to borrow money means choosing a platform that puts clarity and convenience first. For anyone searching for the best place to get a loan, Lend For All Canada stands out by offering smart matches between borrowers and trusted lenders. With simple applications, fast credit approval, and reliable loan offers, Canadians are getting the support they need to meet their financial goals.

Frequwently Asked Questions

How does a personal loan affect my credit score?

Making personal loan payments on time will improve a credit score because payment history is a major factor reported to credit bureaus.

Do I need to have a high income and credit score to borrow money through Lend For All Canada?

Even borrowers with less-than-perfect income and credit score can find borrowing solutions because Lend For All Canada works with a wide network of alternative lenders.

Can I use a personal loan to consolidate debt?

Yes, a personal loan will be an effective way to consolidate debt and simplify monthly payments into one fixed rate loan.

Are there fees involved when I apply for a loan through Lend For All Canada?

Lend For All Canada connects applicants with lenders without charging upfront fees or requiring unnecessary credit checks.

How does Lend For All Canada protect my financial information when applying online?

Lend For All Canada uses secure technology to protect financial information, including bank account details, during the application process.